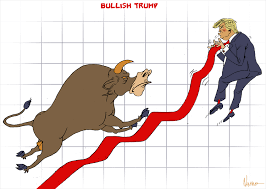

The US equity market has been on a tear despite global slowdown and trade tensions. The recent phase one trade deal agreement has prevented a full blown trade war and created a tailwind for a strong start to 2020. Most of the stock market pundits expect the decade old bull market to thrive again this year with target prices ranging from 3500 to 3700 on the S&P 500. The melt up in the market has also been ignited by more money printing from the Fed as the central bank cut interest rates 3 times in 2019 coupled with the Fed’s massive injection into the Repo market (we call this QE4) in a bid to rescue the overnight lending market. The current investors sentiment is mimicking the enthusiasm we had in January 2018 right before the huge selloff as the Daily Sentiment Index is registering well over 90% bullish extreme. The CBOE’s PUT to CALL ratio is exhibiting extreme call buying as investors show no sign of being defensive. The bid to buy everything in sight has elevated the S&P 500 price multiple to 19.2 times earnings. Earnings are the backbone of a strong bull market and last year many of the earnings came in well below expectations. The stock market has been rallying on the hopes of higher guidance which has caused the multiple to expand. Furthermore, when looking at the market through the Elliott Wave pattern, all broader indices are reaching the top of larger cycle degrees, it is starting to signal Multi-Decade top has formed but it can not quite pinpoint the exact inflection points. President Trump will do whatever he can to hold up this market, if he doesn’t he has virtually no shot of getting reelected. It will be interesting to see how the Elliott Wave pattern will shape up leading up to November when EW is already flashing a significant top is forming.