Welcome!

Please check the Dashboard daily for updated market commentary.

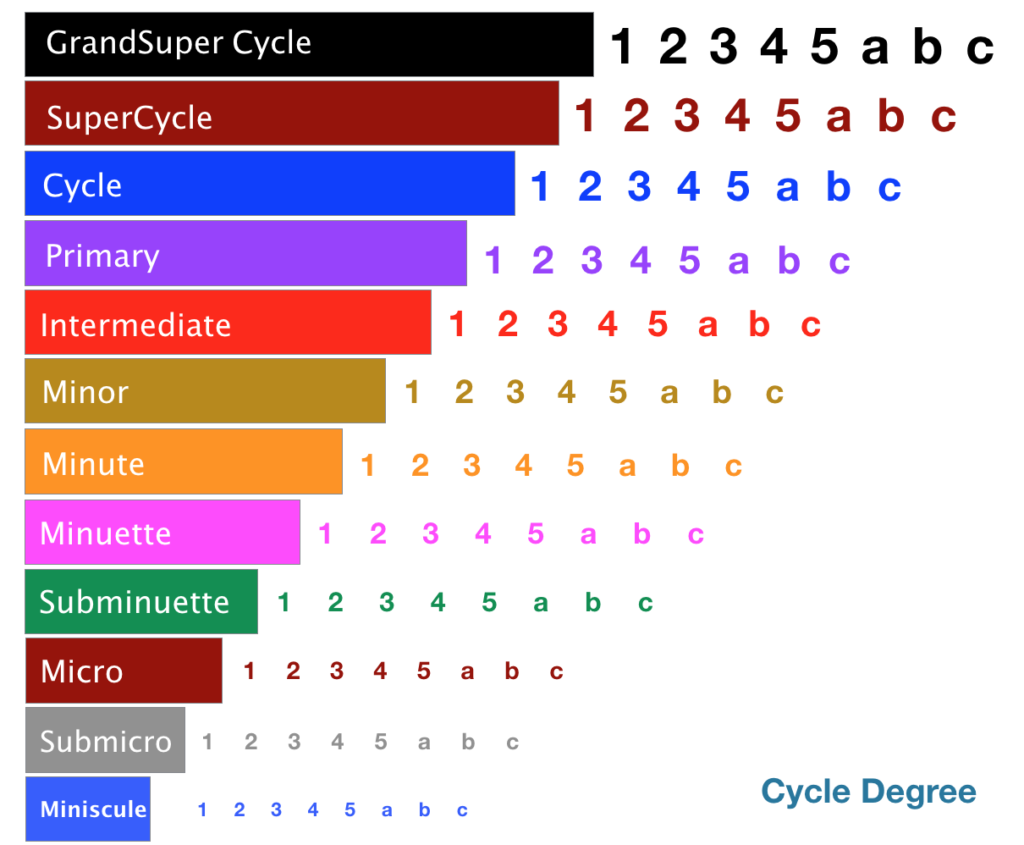

Due to the specificity of our wave counts we have included a labeling system to break down the level or degree of the wave which represents the size of the underlying trend.

After the last day of trading each week we will go over the most salient points with weekly market comments below.

Please note, all of our updates follow New York, Eastern Time Zone of USA.