Solana is a high-performance, open source blockchain platform built to enable scalability for decentralized apps and marketplaces. It was created in 2017 by Anatoly Yakovenko, who sought to solve blockchain scalability issues by harnessing parallelization and innovative consensus mechanisms.

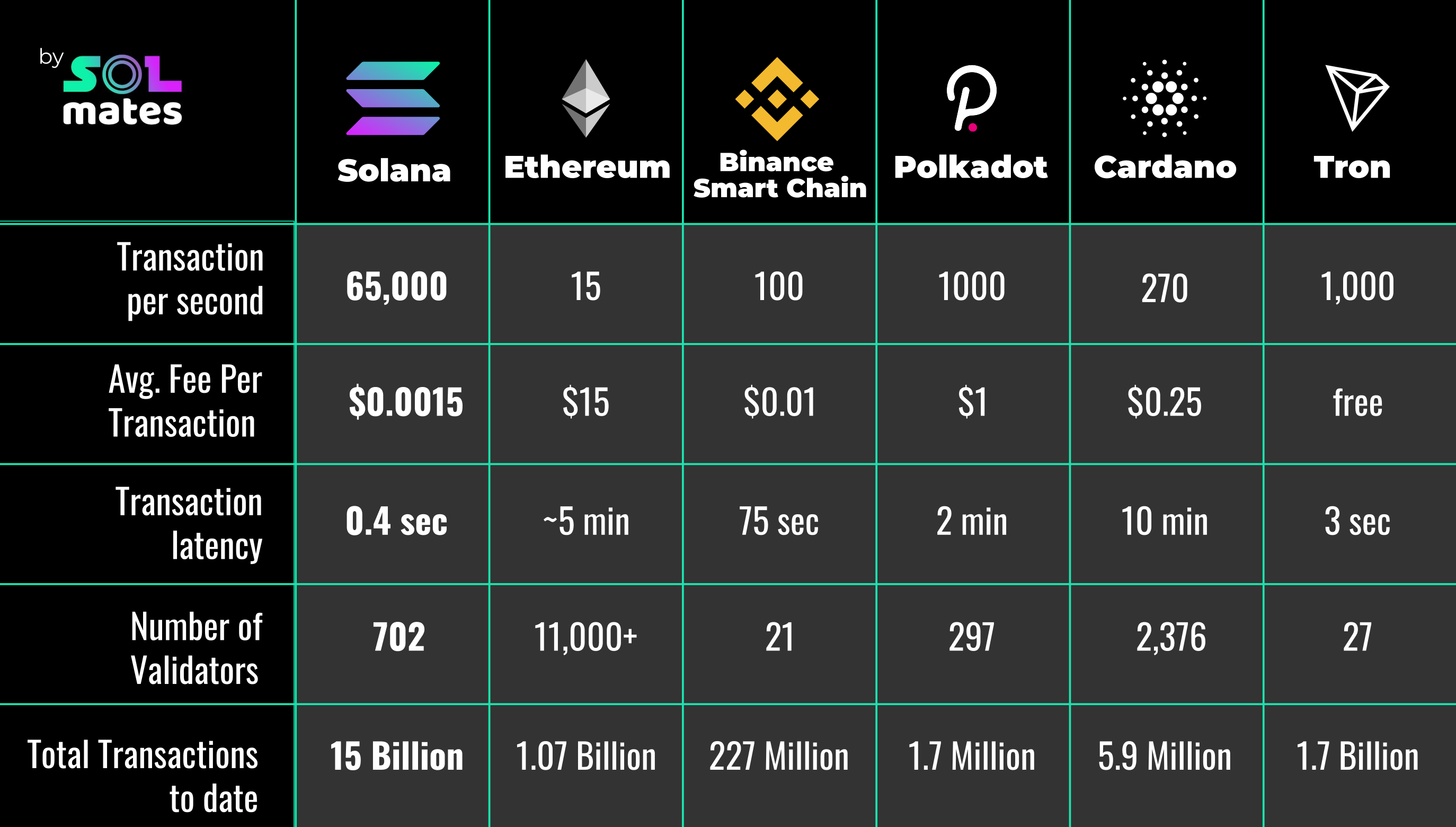

Solana prioritizes speed, cost-efficiency, and scalability. It uses a combination of Proof-of-Stake and Proof-of-History verification methods to achieve lightning fast validation times. This allows the network to maintain 1-2 second block times, processing over 50,000 transactions per second – significantly higher than Bitcoin or Ethereum. Solana is also flexible enough to power a wide range of crypto projects like NFT, DeFi, and Stablecoin.

Solana generated tremendous hype in 2021, with fans touting its ability to solve the Ethereum blockchain’s core problem. Solana, it was promised, would be a cheaper and faster place to handle transactions, a better springboard for decentralized finance, or DeFi, and other activities powered by smart contracts.

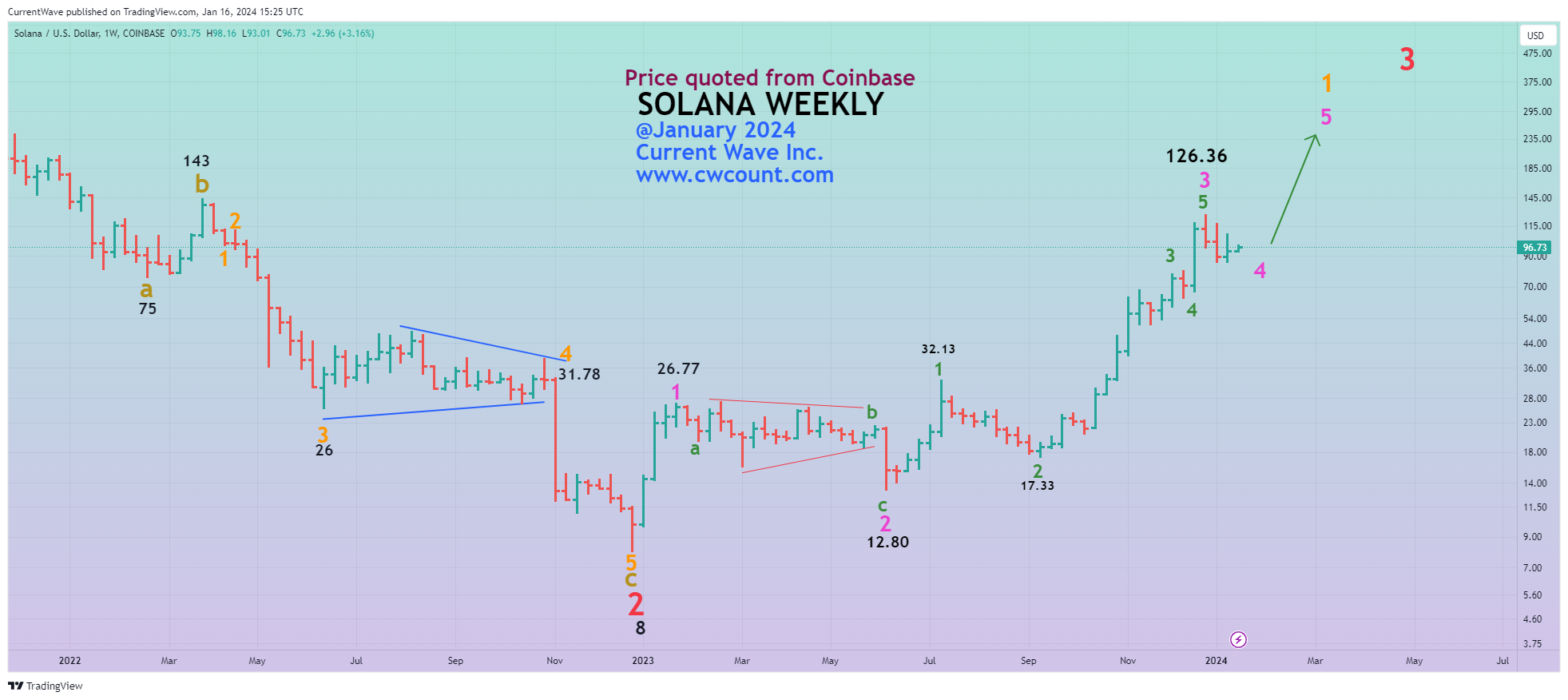

Then came 2022 and all that pain. Things looked bleak for Solana It didn’t help that Sam Bankman-Fried was closely linked to Solana and its SOL token, which sank below $10.

SOL was back in the $20s in October as SBF was on trial. Then, all of a sudden, Solana and SOL turned into just about the hottest things going. But recent events show Solana may be a serious competitor to Ethereum than ever before.

Solana brings groundbreaking innovations in blockchain architecture that enable industry-leading speed, scalability, low fees, and energy efficiency. Despite limitations around stability, Solana shows immense potential for capturing developer mindshare and real-world adoption among consumers and enterprises. The current surging growth in DeFi, NFTs, gaming, social platforms, and institutional use cases demonstrate product-market fit and demand drivers through 2024.

Ethereum remains the leader among layer-1 blockchains that can run smart contracts, aka the bedrock of DeFi. Ethereum has $29 billion of total value locked, a measure of money stashed in a particular blockchain’s ecosystem, far exceeding Solana’s $1.5 billion, according to DefiLlama data.

Despite Ethereum’s dominance, there remains massive room for growth in global dApp users. Solana, with its easy onboarding and low costs, is well positioned to capture new adopters.

If ETH maintains its 90% dApp market share, Solana’s 10x user growth in 2022 shows it can rapidly gain share in this expanding market. Moreover, Solana continues to see surging developer interest with 1000+ monthly hackathon projects built on the platform. This grassroots adoption points to a bright future.