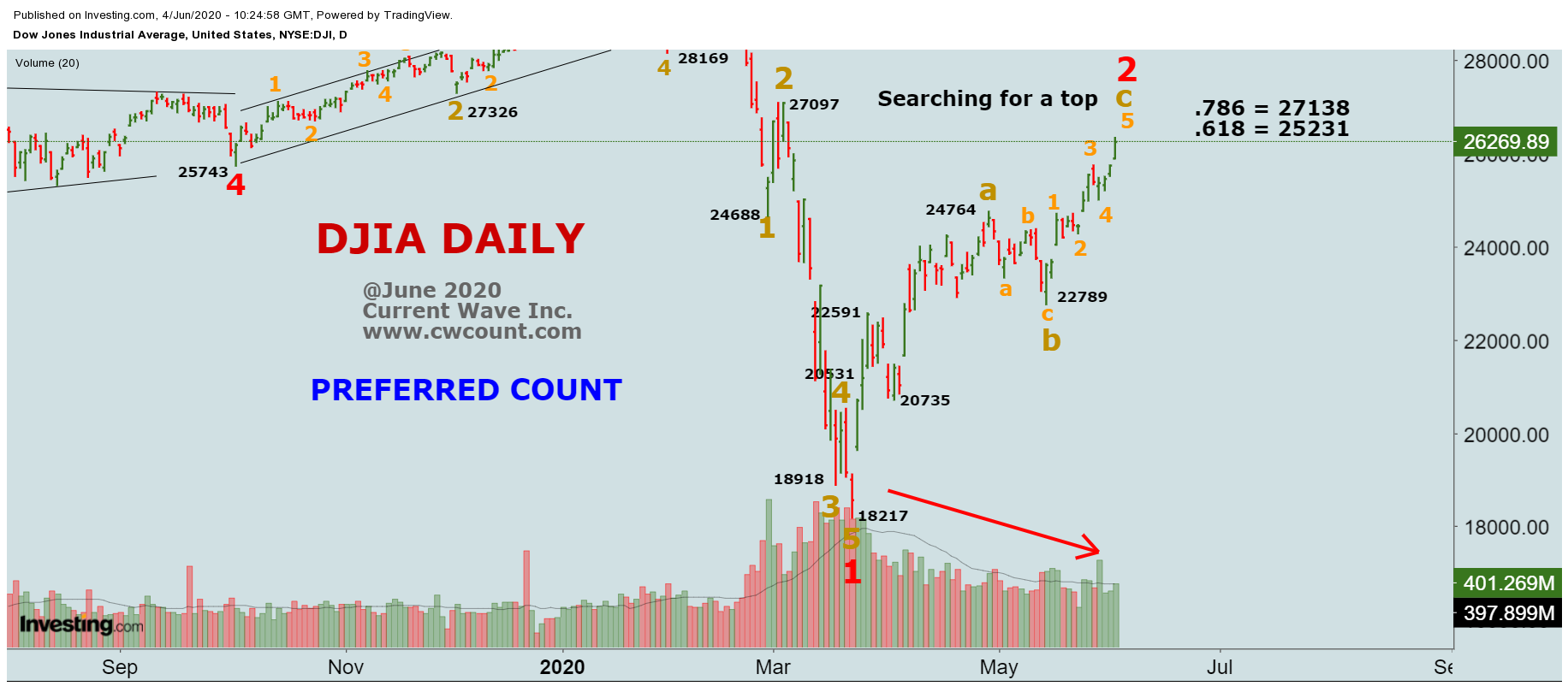

Elliott Wave theory explains 2nd wave behavior as: The second wave of Bear Market corrective phase sees a strong retracement of the movement experienced in the first wave. While the prices can retrace up to 100% of the first wave, it typically retraces between .618 and .786 Fibonacci of first wave. Many market participants still optimistically see the second wave bounce as a return to the prior trend and believe the first wave event as an aberration or an outlier and the bull market which has lasted more than 11 years will continue indefinitely.

The money printing has managed to erase the bulk of the selloff from late February and again Jerome Powell’s infinite QE has been very effective towards bidding the market higher. One would think if you keep doing the same thing over and over again, it will eventually lose its effectiveness or its potency. That is still not the case, as Mr. Powell has saved the stock market again along with the 1% who run wall street while main-street is losing jobs in record numbers and struggling to make ends meet. The Fed has overwhelmingly disconnected asset prices from the economy and the market is rallying purely on multiple expansion (future growth). In our opinion, this is not sustainable, the liquidity driven rally without consideration of earnings/future earnings or valuation has no foundation in the stock market. Whether the next turmoil is deflation or hyperinflation or another wave of Covid 19, Elliott Wave 3rd wave is projecting there is another carnage coming and it’s not IF but When.