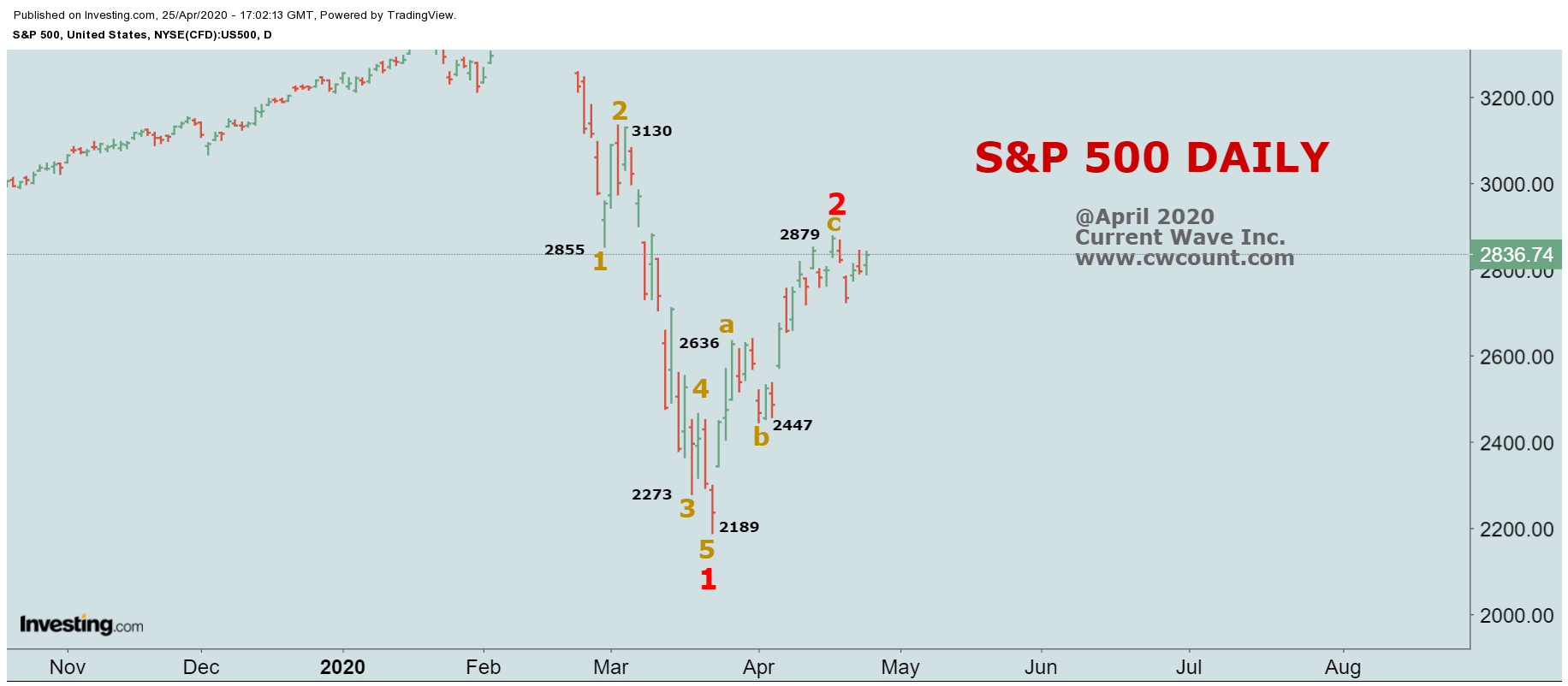

For the bullish market participants that think simply ignoring all of the negative economic headlines due to the fact that the Fed will print as much money as possible seriously need to have their heads reexamined. After the first wave of carnage that began in the month of February, the complacency seems to have returned as the VIX has fallen roughly 50% from the recent highs. First of all, Bear Markets do not last a month, second, Bear Markets end in despair not on hope or on a buy the dip mentality. Bear markets end when wide ranging complacency turns into outright desperate acts of capitulation. Meanwhile, the Fed is trying to save the world again, engaging in distorting asset prices from the fundamental reality with re-inflating the bubble that produces no economic growth other than driving up astronomical valuations in the stock market. It’s propping up non investment grade companies that are teetering on bankruptcy instead of letting these companies fail. It’s again rewarding CEO’s that failed to properly allocate and manage the company’s capital. And again, none of the stimulus is going to help the main street who is suffering tremendously; it will again favor the top 1% or mainly wall street. The recent rebound in the stock market raised the multiple to the most expensive level since the dotcom era as the earnings estimates continue to collapse with the GDP numbers forecast to decline 20% plus. The dotcom crash of 2000 resulted in a 60%+ decline and the Great Financial Crisis of 2008 resulted in a 100%+ decline from their respective highs. S&P 500 is down 35% from the record high, and the current crisis is worse than 2 events put together. Still think V shaped rally coming?