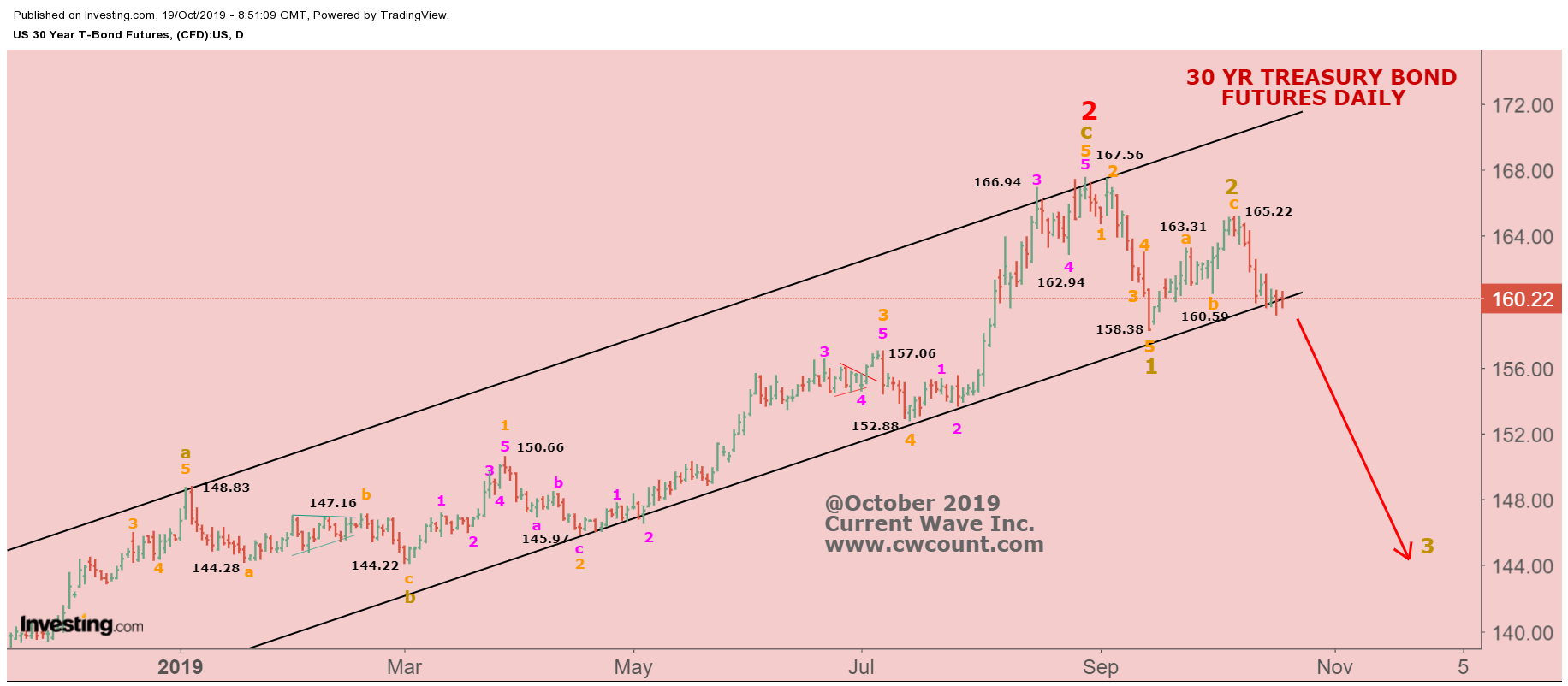

Recession worries and interest-rate cuts from the Fed have boosted bond prices across the board.. But worries that the gains can’t go on forever have led some investors to dump bonds, are they right? On September 9th, we posted our 30 year bond count as we stated in our premium service, “Taking out the prior 4th wave low is a good sign, looks like 167.56 will finally be marked as a major top“. We traced a very discernible 5 count for minuette wave that completes the 5 minute wave of minor wave C of intermediate wave 2. Our count was confirmed by the Daily Sentiment Index which was at the extreme of bullish bias, a level last seen when the Bonds peaked on July of 2016. Thus, we concluded the parabolic run on bond prices is over and the bond prices could be at the forefront of a major selloff, yields are likely to move much higher in our view.

Posted on Sept. 9th

Our current Bond count