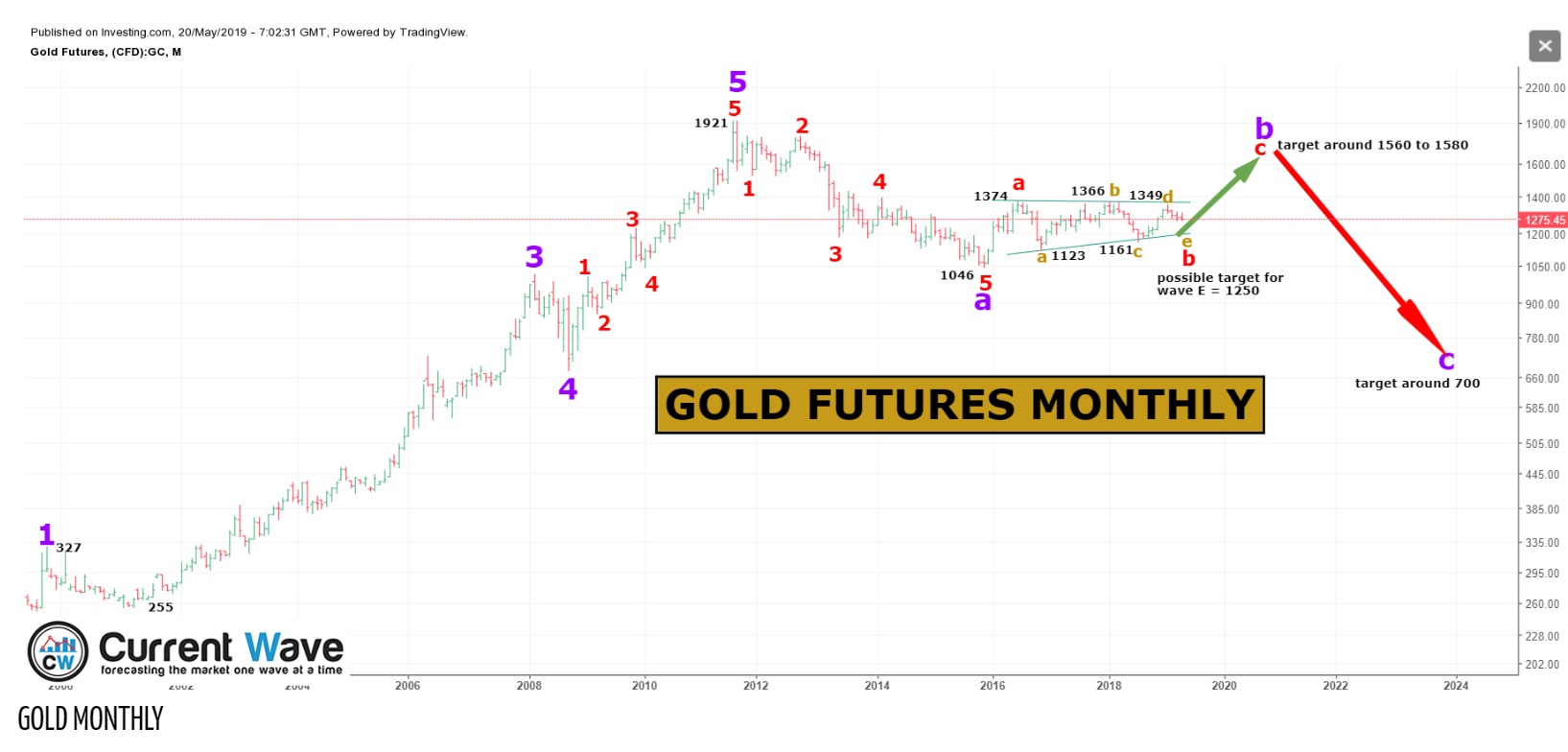

Falling interest rates, fears and uncertainty surrounding the ongoing trade war between the US and China caused investors and traders to bid up gold. Here is our comment on GOLD on May 22nd, “Here is the big picture on GOLD again, we think GOLD is setting up for an explosive move to the upside, this should be a VERY HIGH RISK/REWARD trade on the LONG side. We prefer one big move down to shake out the weak longs before a sizable upside occurs. again, $1250 area should be the ideal entry point on the long side”.

Posted May 22, 2019.

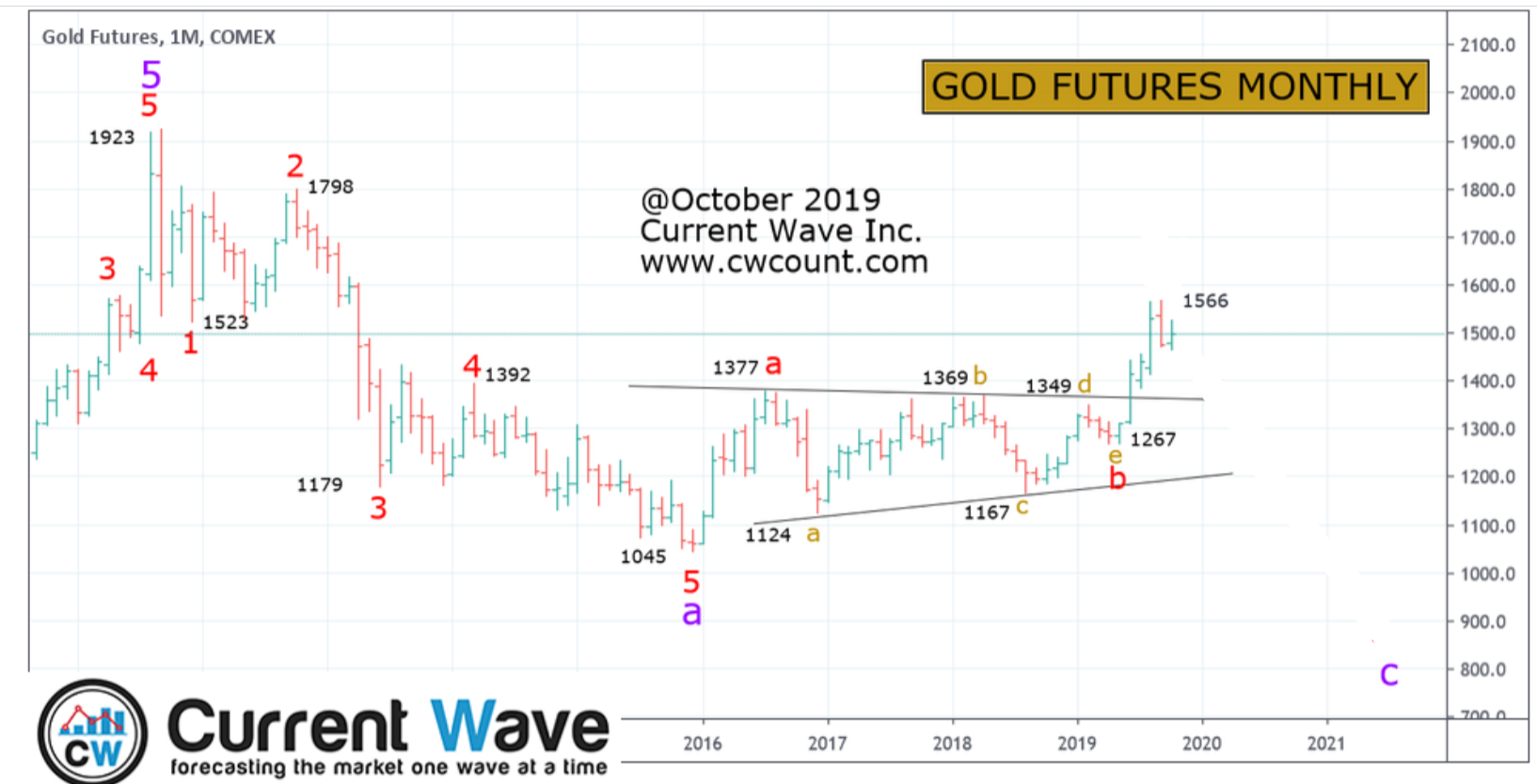

GOLD has been inside the triangle for the past 3 years, we told our subscribers when triangle concludes there will be a final thrust to complete Primary wave B in the high $1500 area, Gold recently topped below $1570 area and retreated, the topping coincided with the investors sentiment at bullish extreme. Is the GOLD rush over or is there another rush underway? There are 2 viable paths which is explained in our CW’s Bronze Plan..

Current Gold chart