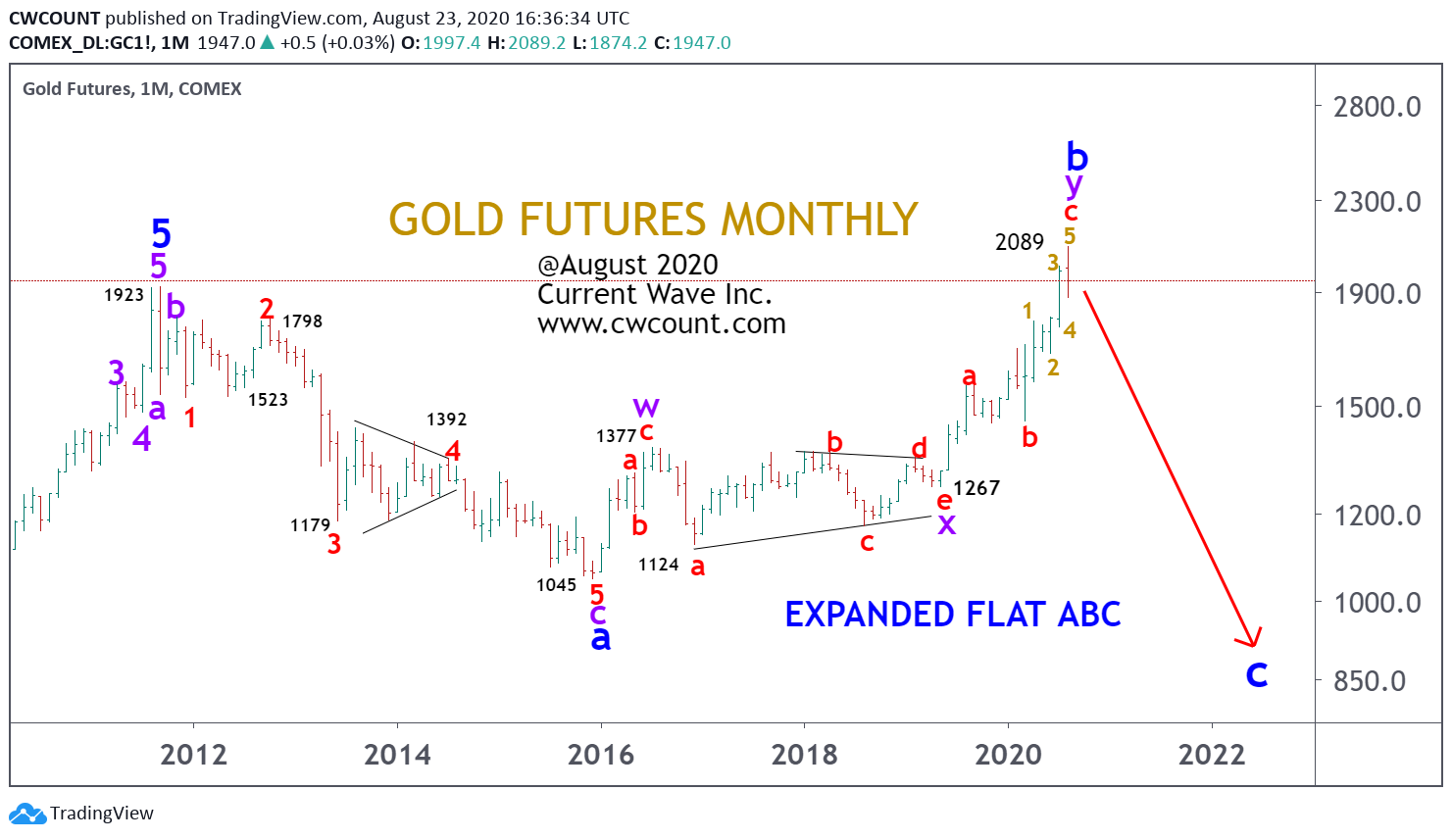

Expanded Flat pattern for GOLD seems like the right call. We did not expect for Gold to break 2011 high as all 5 cycle degree counts have been accounted for from the early 1900s (see below).

When it broke the high the only other pattern viable was the expanded flat pattern where wave B exceeds the 2011 record high price. We were skeptical at first but once we got the downswing on GOLD, it gave us confidence that expanding flat was the right call (see below). Mainstream media’s punditry may suggest much higher prices for gold but very forward looking tool of EW is saying, not so fast.

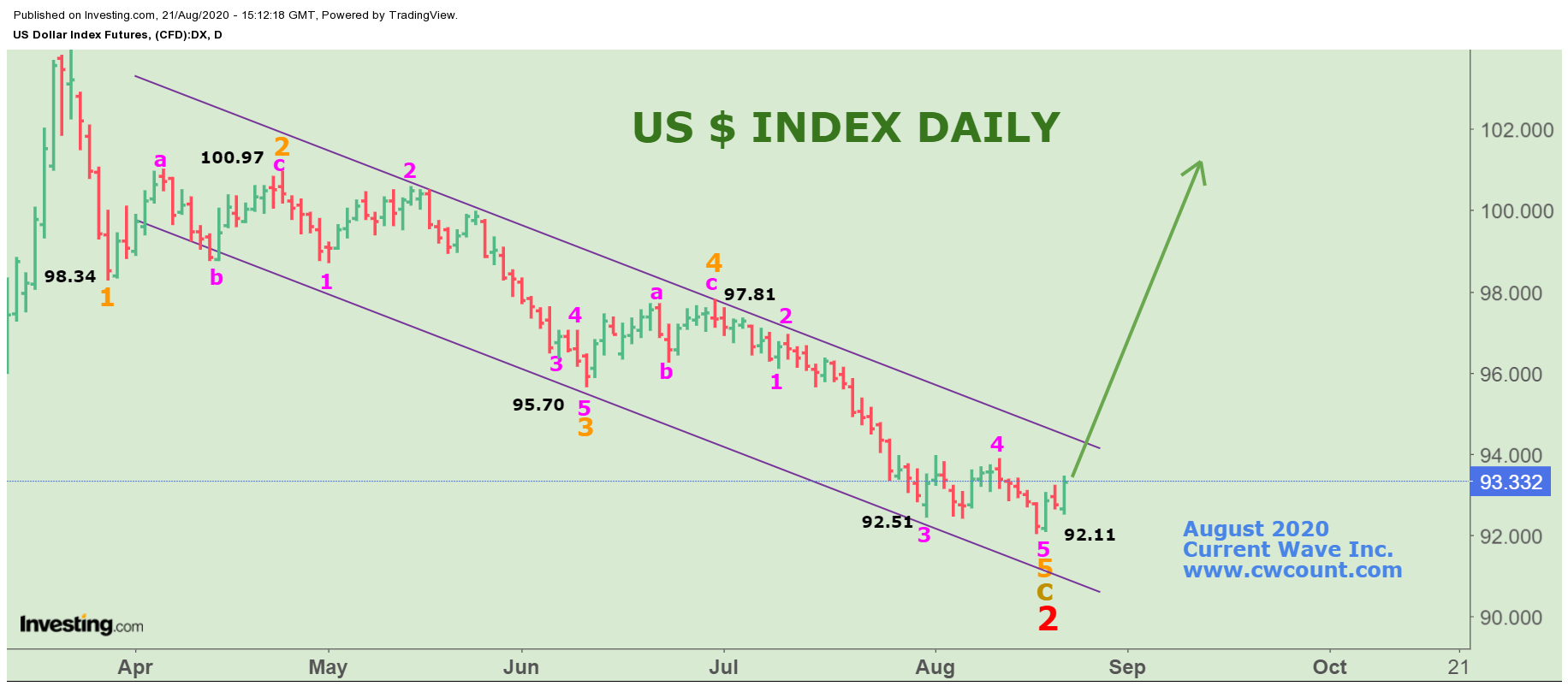

What is interesting now is the set up for the Dollar Index DXY. DXY just completed 5 impulsive waves down from $102 to $92 which was the completion of wave C of intermediate wave 2 (see below). The investor sentiment on the $ is getting ever more bearish for the greenback as many mainstream pundits worry about the record level of money printing from the fed.

It’s very interesting to see the ideal set up here, GOLD which just triggered a multi year decline and the dollar which is at the forefront of a huge rally. And guess what? Look at the bond count (see below), at the forefront of a huge selloff based on the 3rd wave count. Guess no YIELD CURVE CONTROL from the Fed Minutes was very telling when Elliott Wave count on the 30 year Bond is calling for a huge selloff. Paradigm is shifting, we can feel it.

Bonds, Dollar & GOLD lining up

August 23, 2020

by Current Wave Count